Neighborhood Assistance Program Credits

Qualified donors receive a tax credit equaling 70% of their gift to Metro Lutheran Ministry!

Ask about MLM's 70% NAP Tax Credits!

NAP provides tax benefits for Missouri businesses and individuals with business related income, who financially support MLM’s Northland homeless services program expansion. When your business donates to MLM to support this program, it will receive a credit equal to 70% of the donation to reduce your MO state tax liability.

You receive a significant tax benefit and MLM is able to provide more services to homeless and at-risk individuals and families in our community. It’s a win-win!

Metro Lutheran Ministry is excited about our expansion of services in the Northland.

With the support from eligible gifts made to MLM for Neighborhood Assistance Program 70% MO state tax credits, MLM will be able to offer the following expanded services through a case management office at Mimi’s Pantry in Riverside, MO:

- Case management, financial and employment coaching

- Rent, mortgage, and utility assistance to prevent eviction and homelessness

- Rapid re-housing to help families, youth and individuals obtain and maintain rental housing

- Birth certificates, ID, and transportation assistance

- Other emergent needs assistance

Who is Eligible?

Any qualified person, firm, or corporation in business in Missouri is eligible to receive credits, including:

- Individuals with income from royalties or rental property

- Farm Operations

- Sole Proprietors

- Corporations

- S-Corporations

- Limited Liability Corporations

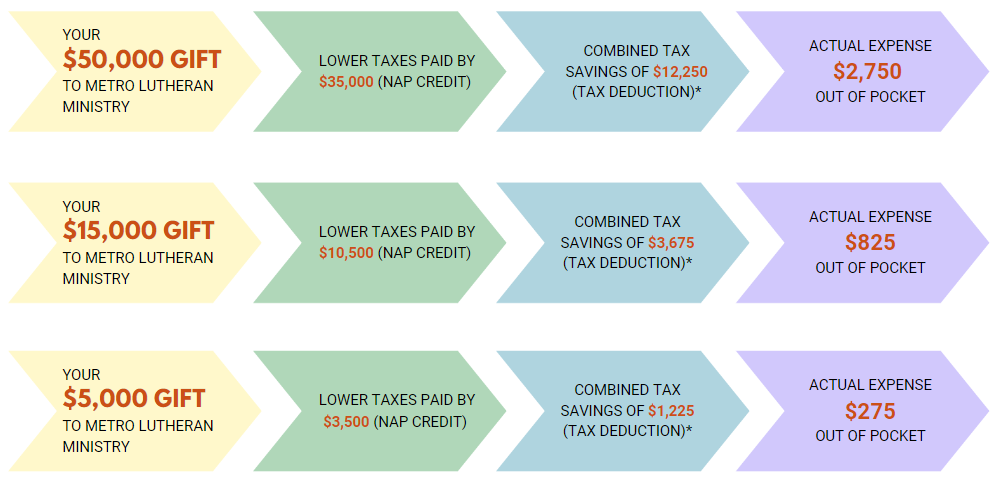

How It Works

*Based on a 35% federal tax bracket

**The examples are for illustrative purposes only. Please consult your tax advisor to learn how tax credits will benefit you specifically.

Getting Started

For more information on eligibility, availability, or to initiate your donation, contact Becky Poitras, VP/Assistant Executive Director, at beckypoitras@mlmkc.org or 816.285.3149.